lexington ky property tax bill 2020

Such As Deeds Liens Property Tax More. Issue over 100000 bills each fiscal year.

Fayette County Sheriff S Office

2020 Delinquent Property Tax Bill List 6221 2021 State Property Tax Rate Tables.

. You can pay with check or money order. Lexington KY 40507 Tel. The TreasurerCollector is appointed by the Town Manager and supervised by the Assistant Town Manager for Finance.

Lexington ky property tax bill 2020. Please select delinquent tax inquiry or call our office at 859 253-3344 for payoff information. Kentucky Property Tax Rules.

A total of 119226 property tax bills with a face value of 389490441 are being printed and mailed. Kentucky voters head to the polls on Tuesday to cast their ballots in primaries. Thats if lexington was able to keep 100 percent of that tax.

Search Valuable Data On A Property. Total recap of votes - may 17 2022. Total recap of votes - may 17 2022.

For additional information on paying your taxes online click here. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. For information on these bills please contact the Fayette County Clerks Office at 859 253-3344.

For any taxpayers property that is assessed by the Department of Revenue and any Fee in Lieu of tax property the Others box needs to be searched using the taxpayers name. 859-252-1771 Fax 859-259-0973. Thats the assessment date for all property in the state so taxes are based.

BY PVA ACCOUNTPARCEL NUMBER. 2 days agoKentucky 2022 primary election results. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

Legal description property location and tms number. If you do not receive the decal within 5-7 business days please call 1-803-896-5000. Mar 1 2022 1115 AM EST.

This rate is set annually by July 1 and it. AP The Kentucky Senate passed a bill Monday that would tap into the states massive revenue surpluses to. Vehicle Tax paid in.

The Tax Collector and staff. 072 of home value. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision.

Property taxes in Kentucky follow a one-year cycle beginning on Jan. 1 of each year. Payments may be made online here.

The median property tax in Fayette County Kentucky is 1416 per year for a home worth the median value of 159200. If you have questions regarding your tax. Start Your Homeowner Search Today.

The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. May 17 2022. Property Tax - Data Search.

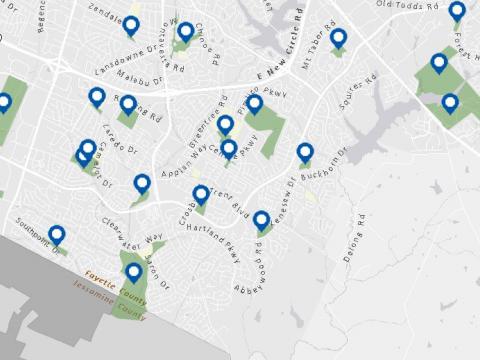

Information at the top of the tax bill identifies the property that this tax bill is for. Find Lexington Property Records. Fayette County Kentucky Property Valuation Administrator The Property Valuation Administrators office is responsible for.

Tax amount varies by county. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Property tax payments made between receipt of bill and November 30 will.

Property Tax Search - Tax Year 2020. If you do not have this information available please contact our Property Tax. Ad Get In-Depth Property Tax Data In Minutes.

Maintaining list of all tangible personal property. Office of the Fayette County Sheriff. Search tax data by vehicle identification number for the year 2021.

Trump won the solidly red state by a 25 margin in 2020. This website is a public resource of general information. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy.

Public Property Records provide. Three items at the top of a real estate tax bill that identify the property are. Fayette County collects on average 089 of a propertys assessed.

Drop off your payment and bill stub in the LEXserv payment box outside the Government Center at 200 E. Please enclose a check or money order payable to Fayette County Sheriff along with your tax. You must have your tax bill number and account number to make payment.

The County Clerks Office is responsible for collecting delinquent property tax bills. Blevins jr clerk. A Lexington Property Records Search locates real estate documents related to property in Lexington Kentucky.

Delinquent Property Tax Department Of Revenue

613 River Rd Greenwood Ms 38930 Mls 105624 Zillow Home Zillow Fixer Upper

Jefferson County Ky Property Tax Calculator Smartasset

Spring Home Sales Could Be The Weakest In Years The Wall Street Journal Refinance Mortgage Refinancing Mortgage Mortgage Interest Rates

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

When Covid 19 Slammed Rural Ky Counties It Found More Vulnerable Patients 89 3 Wfpl News Louisville

![]()

Homestead Exemption Department Of Revenue

1312 Post Oak Rd Lexington Ky 40517 Trulia

It S Property Tax Time Fayette Counties Mailing Notices Abc 36 News

Homestead Exemption Department Of Revenue

And They Re Off Kentucky S Annual Real Property Tax Appeals Season Begins The First Week Of May Frost Brown Todd Full Service Law Firm

Pin By Dodie Sallee King On Marketing The Bain Of Your Success Marketing Planning Calendar Planning Calendar Marketing Plan